For many sales operations and bid desk functions, truly outsized deals are relatively infrequent occurrences. And when they do happen to materialize, these big deals tend to be somewhat unique in their makeup and composition. As a result, it’s tempting to view these deals as falling outside the realms of normal, comparative analysis and relative price determination.

And having drawn these conclusions about the uniqueness of the situation, sellers will too often default to using simplistic or ad-hoc approaches for pricing big deals…which can’t help but increase their risks, leave lots of money on the table, or both at the same time.

So…is there a better approach for pricing big deals that appear to be one-offs?

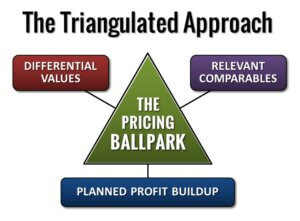

In the “How to Quote Big Deals” training session and research briefing, we explain that while it’s nearly impossible to identify a single approach for pricing outsized deals that can balance all of the various needs, risks, and opportunities involved, leading teams are better-informing their decisions and defining more accurate pricing ranges using a combination of approaches in a triangulated fashion.

By leveraging the principles and practices of differential value estimation, you can determine what the prospective buyer stands to gain from the deal. And while it’s a bit late in the game to influence the buyer’s value perceptions in a big way, these quantitative and qualitative value insights can nudge them in a positive direction, while also shoring up your team’s confidence and resolve.

Then, coming at it from a different perspective, you can find relevant partial comparables to further inform your quoting decisions. By breaking the deal down into its various components, you can almost always find relevant comparables for the 60-70% of the deal that is most important to understand and get right.

And finally, you can develop a more accurate perspective on the “floor price” for a particular deal by estimating the true all-in or incremental costs that you’ll incur should you win and adding the requisite profit to make it worthwhile. It’s a little more work, but this “planned profit” approach mitigates or eliminates most of the major risks associated with using a basic markup-over-product-cost as a floor price.

Of course, the How to Quote Big Deals session provides more detailed explanations of all of these concepts. But the point I want to make in this article is that when it comes to quoting big deals…even deals that might seem to be unicorns…there’s no excuse for just winging it or defaulting to some overly simplistic approach. By coming at it from different angles, you can use imperfect and incomplete information to develop a much more accurate picture of the appropriate pricing ballpark for any given deal.

PS: Even a rainbow-striped unicorn is 97% comparable to a horse. Just sayin’ 🙂