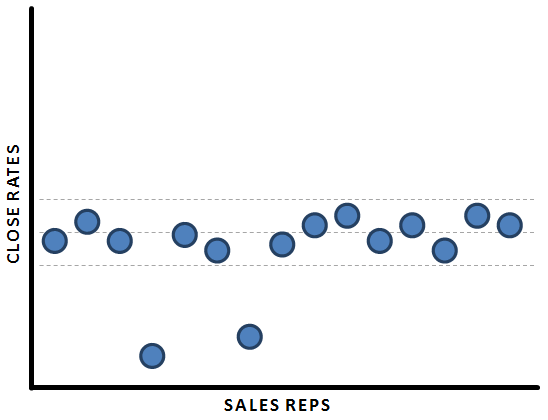

At the risk of scaring every reader away, let’s start with a pop quiz. See if you can spot the potential sales problems in this close rate comparison:

Pretty easy, right? While most are performing within a similar range, there are a couple of reps who might be in need of some further training or coaching to get their performance into the range of their peers.

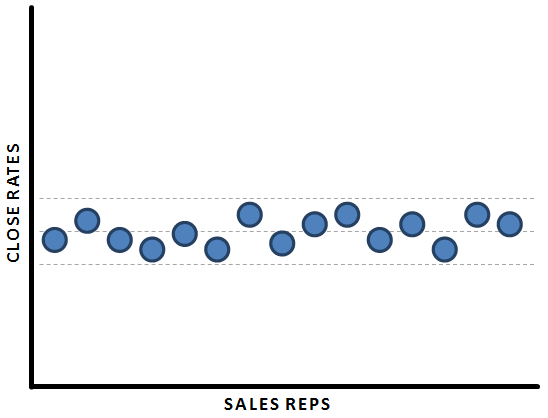

But before you smugly pat yourself on the back, try to spot the problems here:

Looks pretty good, yes? No major problems to speak of, right?

Wrong. There’s definitely a problem. And it’s a huge problem. But you can’t see it because it affects the entire distribution:

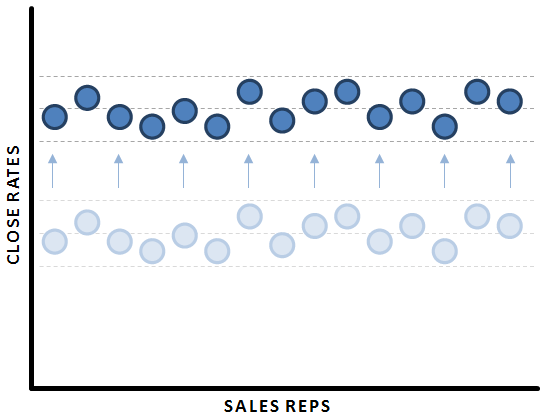

While there are no obvious outliers, every data point in the entire distribution is lower than it really should be. The consistency of the team’s performance is clear and obvious. What’s not so clear is that the team’s performance is consistently falling short of their potential.

We should also recognize that compared to the two outliers in the first chart, the dollar-value of the problem illustrated in the third chart is at least ten-fold. While getting a couple reps performing up to their peers might be worth a few hundred grand, getting the whole team up to their potential is likely worth tens of millions!

As we’ve highlighted before, there are a number of things than can have an overall dampening or constraining effect on sales performance, from negotiation skills and targeting criteria to value communication and product management. And because the influence of these types of things tends to be extremely broad and diffuse, they’re very difficult to recognize.

Simply put, these things don’t stick out as something that’s clearly “off” relative to everything else because they’re causing everything else to be off, too!

So…if these types of problems aren’t likely to be obvious and don’t tend to stand out in the data, how can you know whether or not you’re suffering from them? How do you know if your overall performance is being hampered or constrained by one or more of these wet blankets?

While we can’t be positive without a deeper dive, we can certainly assess the odds or likelihood by just answering some fairly straightforward questions:

- Do you leverage data-driven targeting criteria to focus on prospects with inherently better performance? If your answer is “no” to both parts of this question, you can bet that your sales team is wasting a tremendous amount of time and energy pursuing the wrong types of deals and prospects.

- Does your sales team regularly receive training specific to effective negotiation? If you have to answer “no” to this question, the odds are very high that your team is generally overmatched in the field and you’re leaving money on the table across the board.

- Do your sales and marketing messages clearly convey your value relative to the alternatives? If the answer is “no” and your messages are the garden-variety mix of meaningless platitudes and product specs, there’s little doubt that value perceptions and preferences are broadly depressed.

- Do your product managers employ a value-based approach, grounded in marketing research and competitive analysis? If your answer is “no” to any part of this question, it’s very likely that decisions being made early in the lifecycle are constraining later performance in marketplace.

Because their impacts are so pervasive and pernicious, the benefits associated with addressing these types of problems cannot be understated. It’s not easy, of course. But it is fairly straightforward problem-solving. In fact, the hardest part for many has been recognizing the problems in the first place!