Here at SellingBrew, people frequently ask us how big their sales ops team should be.

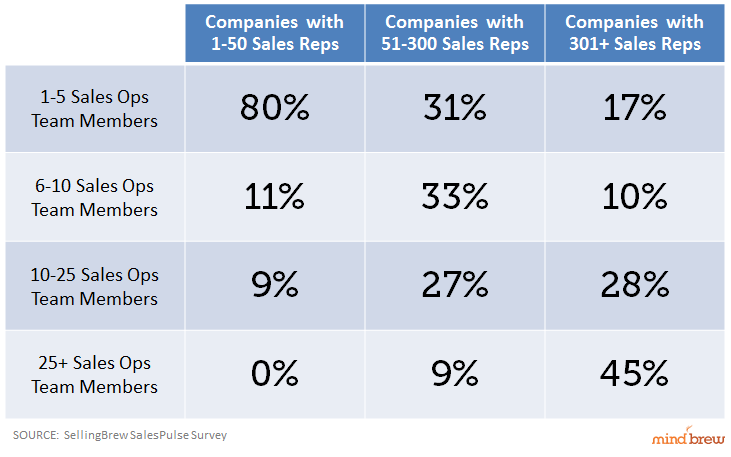

The easy answer to this question is that most successful teams have one sales ops person for every ten to fifteen salespeople. If the salesforce does a lot of traveling, the number of sales ops practitioners tends to be on the higher side, and companies that rely on a lot of inside sales or virtual selling tend to have fewer sales ops people.

We had heard this 1:10 or 1:15 ratio anecdotally from a lot of people, and we were able to confirm it with a SalesPulse survey, as the chart below demonstrates.

What we’ve found, however, is that when people ask us about how many sales ops people they need to hire, they are actually asking a much bigger question. In many cases, what they really want is advice about how to structure their sales ops team.

Because sales ops is a relatively new business function, there aren’t a lot of hard-and-fast rules about how it should be structured. And in fact, we see a lot of variation in the B2B firms that we interact with regularly.

In some companies, sales ops has its own sales ops director or vice president, who reports directly to a C-level executive. In others, the sales ops team reports to the sales director or the sales and marketing director. We’ve also seen sales ops teams that report to managers who then report to the director of sales, services, marketing, or even training.

Another big question is whether the sales ops team should be centralized or distributed. Is it best to have one team that analyzes all of the company’s business units and product lines or should each business unit have its own team? Or should firms take a hybrid approach, combining the best of both?

And how do you determine who does what on the sales ops team? Do you have separate groups for functions like customer retention and sales compensation management? Or do you create ad hoc, temporary teams that focus on strategic initiatives and then move on to other projects once they have created a system that doesn’t require a lot of daily maintenance? Or should organizations set up a “Center of Excellence”?

Each of these approaches has its own strengths and weaknesses, and what may be right for one company in one industry may not be right for another.

If you’re looking for help in wading through these issues, check out the guide to Structuring Effective Sales Ops Functions. It tackles the three biggest questions about sales ops team structure: whether they should be centralized or distributed, to whom they should report, and how the various functions should be structured. It weighs the pros and cons of the most common approaches and offers solid recommendations based on what highly successful teams have found works for them.