If you live near a coast, you tend to think differently about earthquakes. When the earthquake itself is finally over, while you might be tempted to breathe a sigh of relief, you know that you can’t let your guard down. No way. Not yet. Because even though the earthquake has passed, the tsunami might not be far behind.

So what does that have to do with anything? Well…

Just when we thought the worst of the pandemic crisis was behind us, the “inflation” tsunami has started to gain strength and momentum. Certain sectors have already been dealing with inflationary tremors such as having long-standing stocking orders canceled and repriced, dramatic cost-of-labor increases, drastic currency exchange-rate fluctuations, and so on.

As the key ingredients and accelerators have been building and compounding for a very long time, an inflationary cycle should not surprise anyone who’s been paying attention. But whether it’s to be expected or not, it has the potential to be highly disruptive.

Now, I can’t say precisely how these inflationary dynamics will affect your customers, your suppliers, and your company. Nor can I predict exactly what you and your team will need to do in anticipation or response.

But what I can say…with absolute certainty…is that you should definitely be taking notes right now.

However this particular cycle plays out, it won’t be last. This kind of thing has happened before and it will happen again. Of course, it won’t be exactly the same the next time it comes around. It never is. But it will be similar enough that the lessons you’ll learn in the coming months could make a huge difference.

So, as you deal with the dynamics, work through the issues, and devise operational solutions, be sure to document your efforts with an eye toward “the next time.”

Capture your most important lessons, insights, and observations along the way. Make note as to how the various players in the marketplace are reacting and how that’s working out for them. Document all the steps you’re taking and all the changes you’re making. Explain in detail what worked, what didn’t, and why.

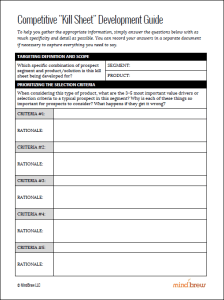

Turn what works into “Standard Operating Procedures” that are triggered by specific market dynamics and early warning signals. Make sure these SOPs are clear, concise, and sufficiently prescriptive that they can be quickly referenced and easily followed by almost anyone in your organization, now or in the future.

Store or publish what you’ve captured and documented in such a way that it’s accessible to others for reference, study, augmentation, and improvement. In the old days, you might add another section to everyone’s “Operations Manual”—the giant binder every department was expected to maintain and reference. Today, you’ll likely want to post the content to your company’s intranet.

The endgame here is that the next time this sort of dynamic comes around, your organization should be able to say, “When we see signs that X might be coming, we should immediately prepare by doing A, B, and C. And should X get worse, we should then do D, E, and F.”

From our vantage point, we tend to see a split when these types of “market tsunamis” pass through. For some companies, dealing with these situations always seems to involve a costly mix of trial-and-error and desperate flailing. At the same time, however, there are other companies that seem to know exactly what they need to do and they just set about doing it, as efficiently and effectively as possible.

Gosh, it’s almost as though these other companies got tired of flailing at some point and decided to create some “cheat sheets” they could reference the next time they found themselves in a similar situation. Hmmmm 🙂